Rate Cut Scenarios, TSMC’s Quarter, and More!

Editor’s Note: TGIF, dear reader!

Let’s get to it!

Fed Gov. Waller: 3 Rate Cut Scenarios

Yesterday, Federal Reserve Governor Christopher Waller indicated that the central bank is “getting closer” to announcing an interest rate cut.

Of course, the likelihood of a cut hinges on upcoming inflation and employment reports.

“I believe current data are consistent with achieving a soft landing, and I will be looking for data over the next couple months to buttress this view,” Waller said in a speech given at the Kansas City Fed.

“So while I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted.”

Reports from the Labor Department and Commerce Department in recent months have shown the once red-hot jobs market finally starting to cool and, likewise, inflation beginning to ease.

According to Waller, there are three potential rate-cut scenarios.

In the first, inflation continues to cool, leading to a rate cut in the “not too distant future.”

In the second, the reports overall point in the right direction but show some unexpected spikes in inflation. In this scenario, the Fed stays in a waiting pattern.

In the third, prices steadily rise, leading the central bank to raise rates again.

In his remarks, Waller said that the third scenario currently looks the least likely.

“Given that I believe the first two scenarios have the highest probability of occurring, I believe the time to lower the policy rate is drawing closer,” he said.

Wednesday’s remarks mark something of a turnaround for Waller, who has been one of the more hawkish members of the Federal Open Market Committee (FOMC). However, this week he conceded that the labor market and Consumer Price Index (CPI) indicate that the central bank’s anti-inflation measures have been working.

“After disappointing data to begin 2024, we now have a couple of months of data that I view as being more consistent with the steady progress we saw last year in reducing inflation, and also consistent with the FOMC’s price stability goal,” Waller said.

“The evidence is mounting that the first-quarter inflation data may have been an aberration and that the effects of tighter monetary policy have corralled high inflation.”

TSMC Reports Quarterly Beat, Stock Falls Anyway

Yesterday, Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) — commonly known as “TSMC” — reported second-quarter results that beat analyst expectations.

TSMC reported a 40.1% year-over-year increase in revenue, to $673.51 billion New Taiwan dollars (roughly US$20.82 billion). Analysts had been expecting the company to report revenue of NT$657.58 billion.

In addition, the company’s net income rose 36.3% from the year-ago quarter, to NT$247.85 billion. According to LSEG, analysts had been expecting quarterly net income of NT$238.8 billion.

On an earnings call, TSMC Chair and CEO C.C. Wei said that the company’s second-quarter gains came thanks largely to continued strong demand for its advanced chips. TSMC’s 3-nanometer and 5-nanometer chips are used in everything from smartphones to artificial intelligence (AI) applications. The company supplies chips to Big Tech giants such as Apple (NSDQ: AAPL) and Nvidia (NSDQ: NVDA).

“I also try to reach the supply-and-demand balance, but I cannot,” Wei told analysts on the call. “Today, the demand is so high I had to work very hard to meet customer demand.”

However, Wei warned that AI chip supply will continue to be “pretty tight” until 2026.

According to TSMC, it is making good progress with the development of 2-nanometer chips. Generally speaking, the smaller the nanometer, the more powerful the chip. The company reported that it expects to begin mass production of 2-nanometer chips in 2025.

For the third quarter, the company is expecting to take in revenue between $22.4 billion and $23.2 billion. That would be significantly higher than TSMC’s revenue of $17.3 billion posted in the year-ago quarter.

However, TSMC’s stock has been trending lower despite the positive results. That’s because of reports that the Biden administration is planning to implement tighter export controls, as well as anti-Taiwan remarks recently made by former President Trump.

Year to date, TSMC’s stock has gained nearly 70%.

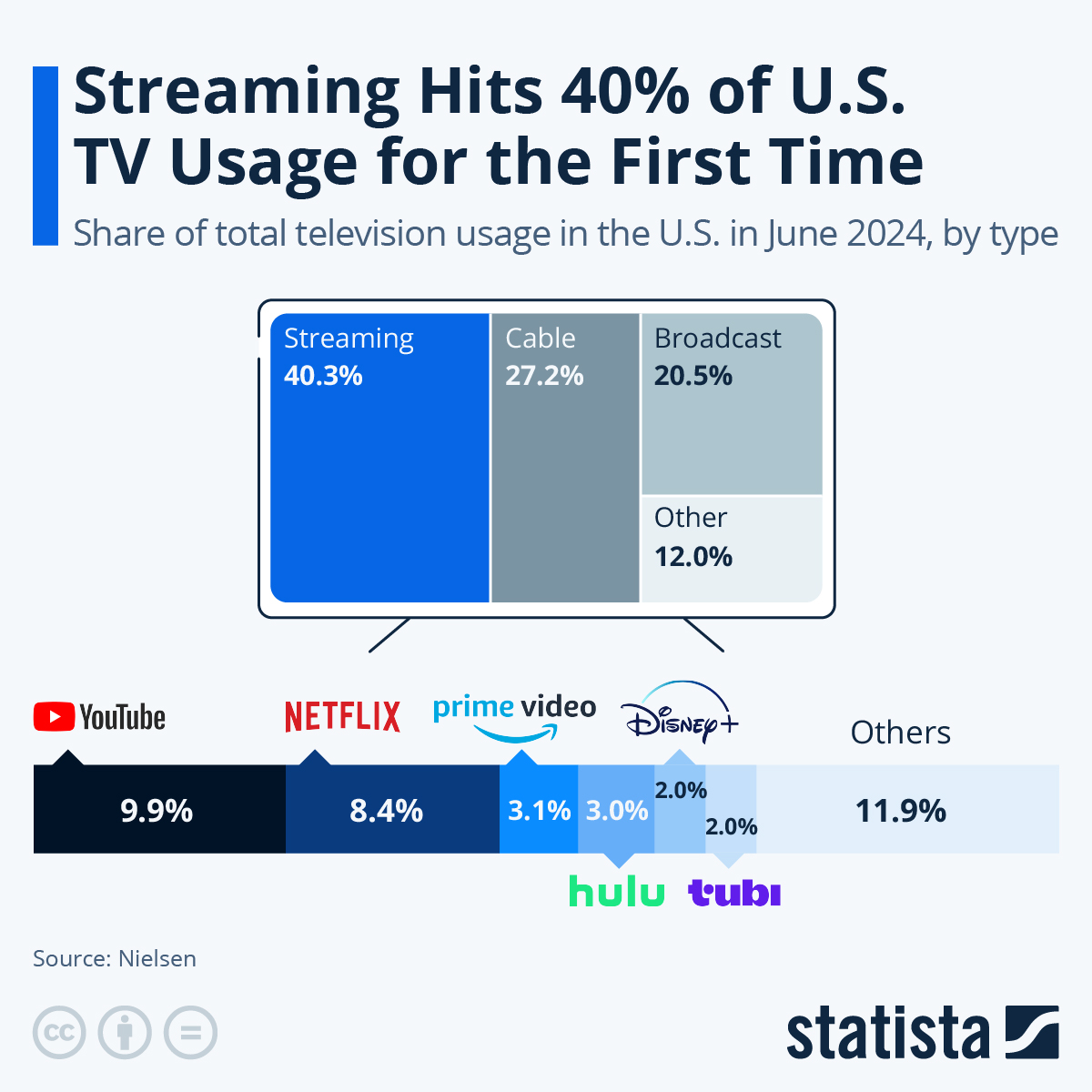

Streaming Dominates TV Viewing

A decade ago, consumers were still weighing whether to “cut the cord” on cable TV and switch to streaming services such as Netflix (NSDQ: NFLX) and Amazon (NSDQ: AMZN) Prime Video. It seemed like a daring thing to do back then.

However, now streaming has become a “norm.” And the options for streaming services have exploded, with every media company worth its salt jumping on the streaming bandwagon.

According to Nielsen’s The Gauge report, streaming services became bigger than cable in July 2022, when streaming views accounted for 34.8% of TV consumption. By comparison, cable TV’s share was just 34.4%, while traditional broadcast TV accounted for just 21.6% of views that year.

In 2023, that trend continued, with streaming’s share of TV views reaching 38.7% in July 2023.

Fast-forward to June 2024, and streaming accounted for a whopping 40.3% of TV viewing, versus 27.2% for cable and a paltry 20.5% for broadcast TV.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality…specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

However, to find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For his premium Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

As the second half of 2024 gets underway, don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.