The Magnificent Seven, Booze vs. Cannabis, and More!

Editor’s Note: Happy Wednesday, dear reader! I hope you are having a decent week so far.

Between the stock market, the economy, and the global geopolitical situation, it has not been a particularly quiet week — that’s for sure!

Anyway, let’s get to it!

The Magnificent Seven: Why They Were Among Monday’s Biggest Losers

On Monday, the stock market took a turn for the worst as investors sold off largely on concerns about the U.S. economy.

Why the doom and gloom?

Last week, the Labor Department reported a higher-than-expected number of new unemployment claims, as well as a slight uptick in the unemployment rate.

As you may imagine, when the economic situation looks uncertain, speculative stocks are the first to take a hit.

In particular, the so-called “Magnificent Seven” stocks — tech companies that soared last year mostly on their artificial intelligence (AI) potential rather than any tangible results — took a nosedive.

By midday Monday, these seven stocks had collectively lost roughly $620 billion from their market caps.

Electric vehicle (EV) maker Tesla (NSDQ: TSLA) — which had been the laggard of the group, as well as of the S&P 500 — took a 4% plunge. As did e-commerce giant Amazon (NSDQ: AMZN).

And software colossus Microsoft (NSDQ: MSFT) plunged by more than 3%.

Google parent Alphabet (NSDQ: GOOGL) and Meta Platforms (NSDQ: META) — the company formerly known as Facebook — also lost more than 2% by early yesterday afternoon.

As for Apple (NSDQ: AAPL), the Cupertino Giant shed more than 5%. However, there were also extenuating circumstances, other than the broader market selloff. Over the weekend, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B) revealed that it had sold off half of its stake in the iPhone company.

And Nvidia (NSDQ: NVDA) — chip designer and Wall Street darling — lost 13% at the start of the, although by mid-afternoon its losses had been pared to 6%.

However, other factors could have played a role in the entire tech stock group’s downturn.

According to a new report from The Information, Nvidia’s next generation of AI chips — its Blackwell range — may be delayed by three months.

Many of the Magnificent Seven players depend on those chips.

Yum Brands Reports a Mixed Bag of Q2 Earnings

Yum Brands (NYSE: YUM) shares ticked lower yesterday morning after the company reported a mixed bag of earnings for the second quarter.

The company, which owns the Taco Bell, Pizza Hut, and KFC fast-food chains, reported revenue of $1.76 billion — short of Wall Street analyst estimates of $1.8 billion, according to LSEG.

Yum also reported that its net income for the second quarter was $367 million, or $1.28 per share. That’s significantly lower than the $418 million, or $1.46 per share, reported for the year-ago quarter.

However, on an adjusted basis, earnings per share came in at $1.35. Analysts had been expecting earnings per share of $1.33, adjusted.

The fast-food giant’s net sales rose 4% on a year-over-year basis, to $1.76 billion. That was thanks largely to the opening of new restaurants.

Same-store sales fell by 1% during the quarter, and both KFC and Pizza Hut saw 3% drop-offs in same-store sales.

Believe it or not, but China is the world’s largest market for KFC. However, despite some additions in this area, the fried chicken chain’s international same-store sales still dropped by 3%.

Here in the U.S., KFC same-store sales fell by 5%, year over year.

Likewise, Yum Brands reported a 1% decline in same-store sales for its domestic Pizza Hut business. The company’s international Pizza Hut division reported a 4% year-over-year drop-off.

The bright spot for the quarter was Taco Bell, which enjoyed a 5% increase in same-store sales during the second quarter.

Taco Bell’s success, compared with its siblings, probably has to do with the Tex-Mex chain’s reputation for being a good value.

Since the COVID pandemic began, fast-food menu prices have skyrocketed. While some of the price increases may have been justified by the pandemic’s negative effects on the global food supply chain — and also by Russia’s war on Ukraine, one of the world’s top grain producers — food commodity prices have since backed down.

Despite this, fast-food chains have continued to increase menu prices.

McDonald’s (NYSE: MCD) has drawn plenty of ire — and negative publicity on social media — from consumers in recent quarters due to this.

As a result, sales at many fast-food and also fast-casual restaurant chains have recently dropped around the world.

That’s led chains such as McDonald’s and Burger King — which is owned by Restaurant Brands Intl. (NYSE: QSR) — to offer special discounts and promotions, such as value menu selections.

Anyway, it looks like the same wariness to spend money on overpriced fast food has hit KFC and Pizza Hut. However, Taco Bell’s reputation for selling cheap eats has helped drive sales to the chain.

Gen Z Is “California Sober”

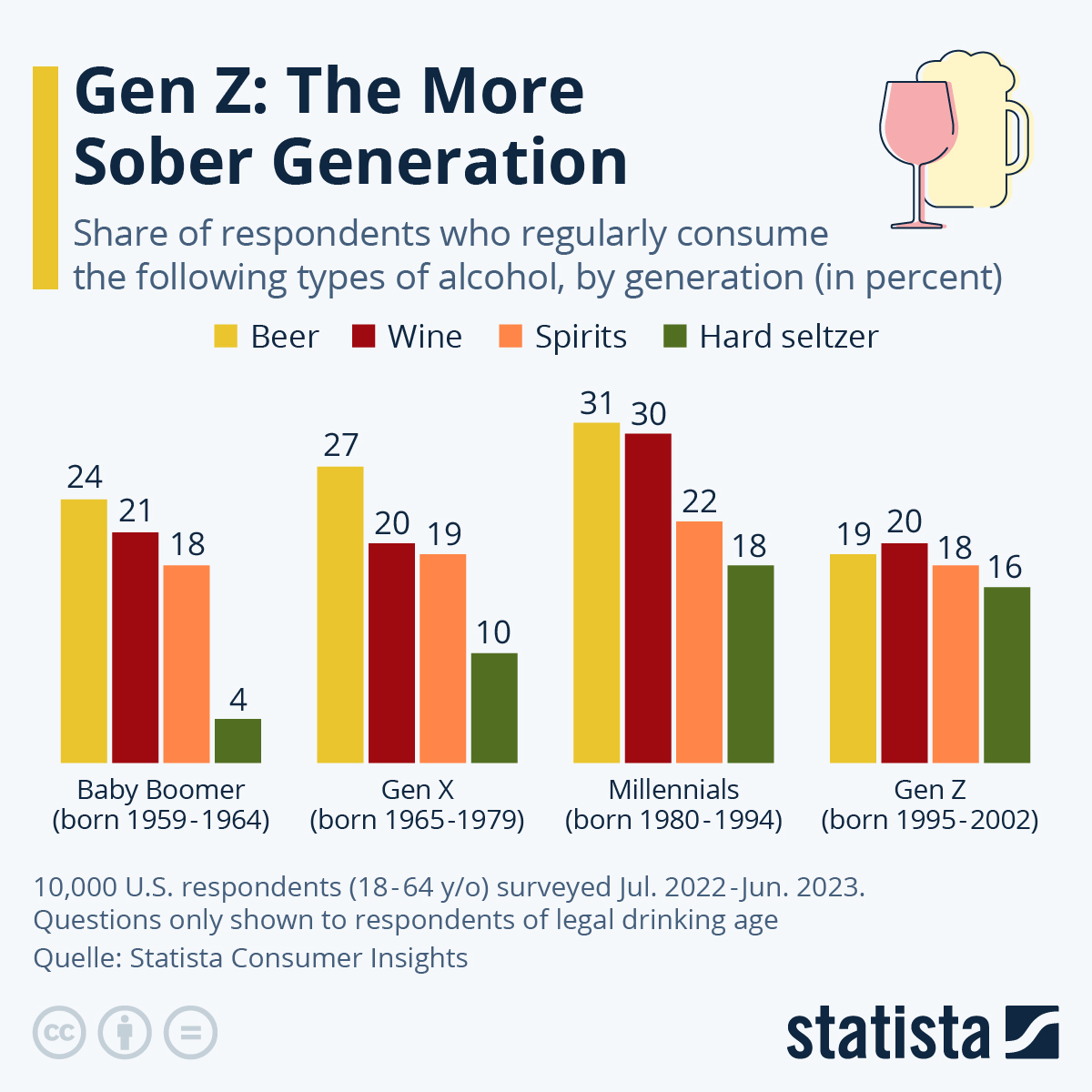

According to a Statista Consumer Insights report, for Americans under the age of 28 — AKA Gen Z — alcohol has little appeal.

Only between 16% and 20% of Generation Z members of legal drinking age told Statista that they regularly drink beer, wine, hard seltzer, or spirits.

That’s a big difference from their slightly older counterparts, the Millennials. Between 18% and 31% of them regularly drink.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Apparently, instead of alcohol, kids these days are turning to cannabis instead.

According to a survey from New Frontier Data, 69% of Generation Z respondents said that they prefer pot to booze.

Now, members of this generation reportedly have about $360 billion in disposable income — making cannabis an increasingly lucrative market.

However, because of the ever-changing legal landscape, the sector is inherently volatile. Before devoting your money to a pot stock, you need to conduct due diligence.

That’s where my colleague John Persinos and his publication, Marijuana Profit Alert, come in. By applying his proprietary screening methodologies, John pinpoints for subscribers the most attractive plays on the “green rush.” To learn more, click here.