Intel, Oil Prices, and More!

Editor’s Note: It’s Wednesday again, somehow.

Let’s get right to it.

Big Changes on the Way for Intel

Intel (NSDQ: INTC) has come under fire lately.

Once the ruler of the chipmaking world, the company has lost way rapidly to Wall Street darling Nvidia (NSDQ: NVDA). Nvidia makes the graphics processing units (GPUs) required to run artificial intelligence (AI) models.

At the start of August, Intel reported quarterly earnings that missed analyst estimates. That included a whopping $1.61 billion net loss.

Also at the time, the company announced that it would lay off 15,000 workers to help cut its huge expenses.

As a result, Intel shares plummeted to their lowest level since 2013.

Now the company is apparently working with several advisors to help it pick up its drooping business.

According to familiar sources, the advisors — which include Morgan Stanley (NYSE: MS) and Goldman Sachs (NYSE: GS) — are expected to suggest that the company split off and sell part of its design and manufacturing businesses. They may also suggest that Intel terminate some of its current factory projects.

It’s likely that the options will be presented during Intel’s board meeting later this month.

Last week, Intel CEO Pat Gelsinger addressed investor concerns about the company at the Deutsche Bank Technology Conference.

“We realize we have to operate efficiently with nimbleness, with urgency,” he said.

However, the news that Intel’s flagging fortunes may be improved were enough to send shares of the chipmaker higher on Friday morning.

Previously, the chipmaker’s stock had dropped by 60% since the start of the year. By comparison, the Philadelphia Stock Exchange Semiconductor Index — which serves as a benchmark for the chip industry — as notched a 20% gain.

According to Gelsinger, Intel is still planning to launch its next-generation laptop central processor, Lunar Lake. And the company is still seeing demand for its foundry business.

However, in order to save Intel, the company may need to sell its foundry unit. Gelsinger has considered Intel’s foundry business — which makes chips for “fabless” chip companies — integral to the company’s turnaround.

But despite interest from potential customers, this division reported operating losses of $2.8 billion in the most recent quarter.

Demand Concerns Send Oil Benchmarks Lower

Oil prices headed lower yesterday on concerns about global demand. In morning trading, Brent Crude — the benchmark used by the Organization of the Petroleum Exporting Countries — fell by nearly 3.5%, while the U.S. benchmark, WTI Crude, dropped by roughly 3%.

This followed last week’s price slump. Oil headed lower last week after OPEC and its allies, OPEC+, signaled it may unwind its planned voluntary production cuts of 2.2 million barrels per day in October.

This week, prices seem down largely due to fears that demand for energy in China is waning.

Over the weekend, China’s National Bureau of Statistics indicated that manufacturing activity in the country dropped for the fourth straight month in August. According to the bureau, the Purchasing Managers’ Index gave off its lowest reading in six months.

China is the world’s largest importer of crude oil, so a decrease in demand there can have a significant effect on the energy markets.

At the same time, there have been reports that a dispute in Libya that has halted production — thus propping up oil prices — is about to be resolved.

Libya’s political factions have been arguing over who gets to control the country’s central bank, as well as its revenue from oil production.

The resulting political standoff led production in Libya to drop to roughly 491,000 barrels per day (bpd) on August 28 — versus 959,000 bpd on August 26, according to the country’s National Oil Corp. Back on July 20, Libyan production totaled 1.28 million bpd.

However, the supply reduction in Libya hasn’t led to an increase in oil prices. According to a note by Saxo Bank’s Ole Hansen, this “underscores the current weak sentiment, which increasingly threatens Brent and WTI’s ability to hold above key support levels that have been in place for more than a year.”

According to Hansen, Brent’s dip below $75 per barrel should trigger selling and send crude lower toward $71 per barrel.

“While the Libyan disruption might have opened a door for OPEC+ to proceed with their planed production increase — starting with 180,000 barrels per day from next month — the risk of prices falling further below the group’s desired and elusive target of $90 per barrel Brent may now compel them to reconsider or postpone this decision.”

Other analysts believe that OPEC+ will plod ahead with its planned production cuts. “It remains to be seen how low prices can go before OPEC+ reacts, as most cartel members need prices above current levels to come close to balancing their budgets,” said Ashley Kelty with Panmure Liberum.

ISM Manufacturing Survey Raises Odds of 50 BP Rate Cut

Meanwhile, a new report about manufacturing has some analysts worried about a potential economic downturn in the works.

According to the Institute for Supply Management’s (ISM) monthly supply of purchasing managers, 47.2% of respondents reported growth in August.

And although the percentage was higher than July’s reading of 46.8%, it was below analyst estimates of 47.9%, according to Dow Jones.

“While still in contraction territory, U.S. manufacturing activity contracted slower compared to last month,” ISM Manufacturing Business Survey Committee Chair Timothy Fiore said. “Demand continues to be weak, output declined, and inputs stayed accommodative.”

He noted, “Demand remains subdued, as companies show an unwillingness to invest in capital and inventory due to current federal monetary policy and election uncertainty.”

Fiore also added that any reading over 42.5% can be indicative of broader economic expansion.

The survey’s employment index rose to 46%, while inventories increased to 50.3%.

But at the same time, the prices index increased to 54%.

Following the ISM’s report, the odds that the Federal Reserve will cut its benchmark interest rate by 50 basis points when it meets in September rose from 30% to 37%, according to the CME Group’s (NSDQ: CME) FedWatch Tool. The odds of a 25 basis-point cut dropped to 63%.

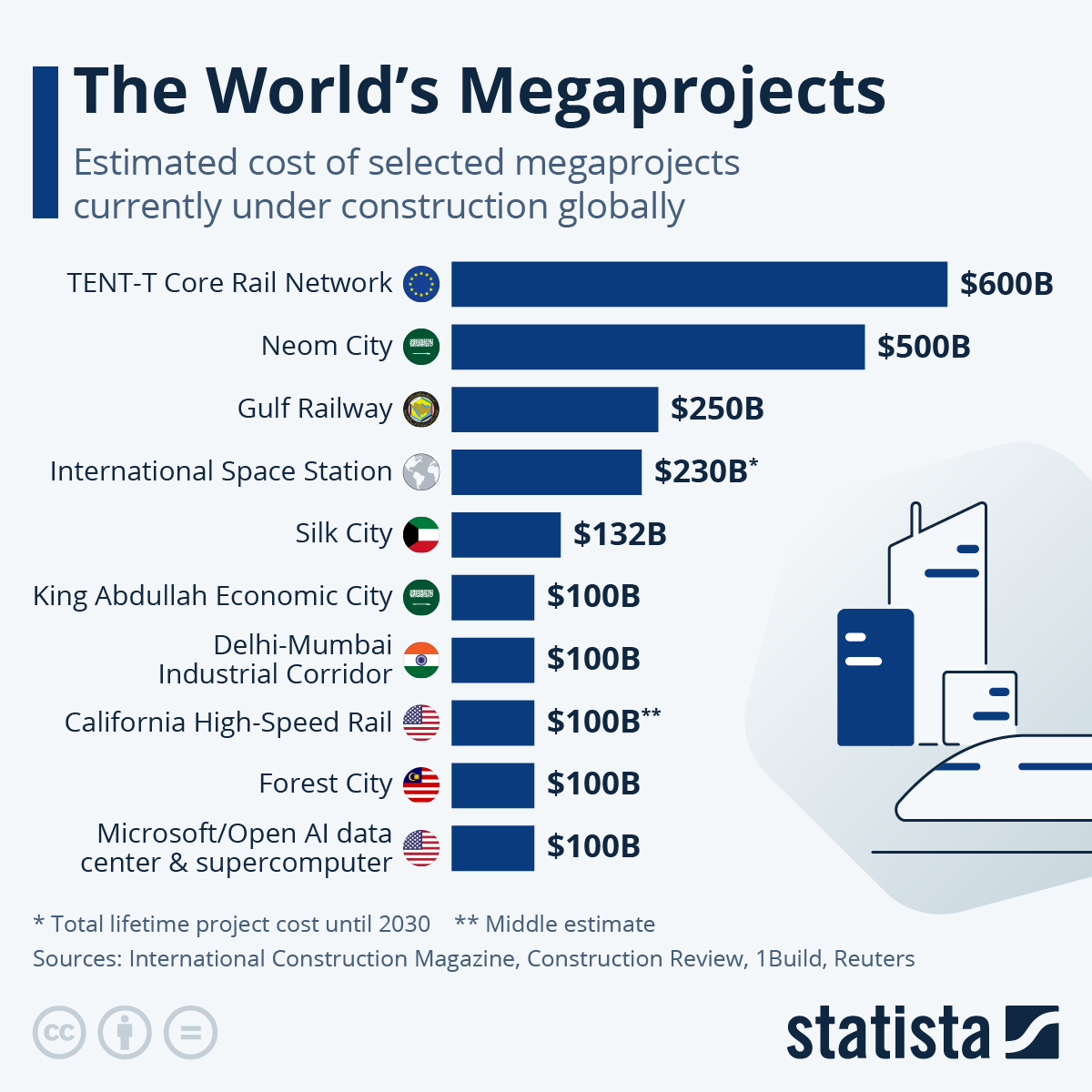

The Enormous Costs of the World’s Megaprojects

Around the globe, big money is being poured into megaprojects — contribution projects that cost more than $1 billion. According to International Construction, nine of them have a pricetag of $100 million or higher.

Currently, the world’s most expensive project is the European Union’s Trans-European Transport Network, an infrastructure upgrade that will see new rail lines, roads, and shipping routes created over the next few years. This project is estimated to cost $600 billion.

That’s more than the $500 billion price tag on Neom City, Saudi Arabia’s ambitious attempt to build a linear smart city in the desert.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality… specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

To find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

Don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.