Nvidia, Job Openings, and More!

Editor’s Note: TGIF, dear reader!

Let’s get to it.

Nvidia Hits the Skids

Nvidia (NSDQ: NVDA) shares fell this week after news broke that the company had received a subpoena from the U.S. Department of Justice (DOJ).

All told, the nearly 10% slump shaved nearly $280 billion off Nvidia’s market cap. That’s the worst one-day market value loss in the history of the stock market.

In fact, that nearly $280 billion loss was bigger than the market caps of some of the U.S.’s biggest companies, such as McDonald’s (NYSE: MCD), which has a market cap of around $206 billion.

According to Bloomberg, no formal complaint has been made against Nvidia. Instead, the DOJ has questions about whether or not Nvidia’s practices make it harder for customers to switch to another brand of artificial intelligence (AI) chips.

Currently, Nvidia controls more than 80% of the market for AI chips intended for data centers.

Unless you’ve been living under a rock, you know that Nvidia’s chips have pushed the company to the forefront of the tech world.

Nvidia counts heavyweights such as Amazon (NSDQ: AMZN), Tesla (NSDQ: TSLA), Meta Platforms (NSDQ: META), and Google parent Alphabet (NSDQ: GOOGL) among its roster of customers.

However, Nvidia’s domination of the market has led to antitrust concerns.

Even before the news broke, Nvidia had been on a losing streak. After its market value topped $3.3 trillion on June 18 — making it the most valuable publicly traded company in history — NVDA shares have lost more than 20% of their value.

It seems that investors are concerned about the company’s ability to maintain its sky-high valuations. In addition, there’s concern that a pullback in the economy could trigger tech companies to dial down their investments in Nvidia’s tech.

Job Openings Fall to Lowest Level Since January 2021

On Wednesday, the U.S. Labor Department reported that job openings fell to a three-and-a-half-year low in July.

It’s yet another sign that the labor market is starting to soften… theoretically amplifying the case for a 50-basis-point rated cut when the Federal Reserve meets later this month.

According to the Job Openings and Labor Turnover Survey, the number of available job openings fell to 7.67 million. That’s a 236,000 drop from June’s downwardly revised total of 7.91 million.

It’s also the lowest level we’ve seen since January 2021. It’s also lower than what everyone had been expecting.

According to Dow Jones, economists had been looking for 8.1 million job openings.

The ratio of job openings per available worker dropped in July to less than 1:1. Back in early 2022, the ratio had been more than 2:1.

“The labor market is no longer cooling down to its pre-pandemic temperature; it’s dropped past it,” Indeed Hiring Lab’s head of economic research, Nick Bunker, said. “Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point.”

The report, also known as the JOLTS report, is one of the Federal Reserve’s most relied-upon gauges of economic health.

According to the JOLTS report, the number of layoffs rose from 202,000 in June to 1.76 million in July. And the total amount of “separations” rose by 336,000 — equivalent to 3.4% of the workforce.

But at the same time, the number of hires also rose. On the month, the number of hires increased by 273,000. That puts the hiring rate at 3.5% — slightly better than June.

The largest number of job openings were in the professional and business services sector, which added 178,000 openings.

However, private education and health services lost 196,000 openings, while trade, transportation, and utilities dropped by 157,000.

According to economist Oliver Allen of Pantheon Macroeconomics, the new JOLTS report “confirms the picture of the labor market that we’ve been seeing for a little while.

“The labor market was looking very tight in a lot of 2023 and into the start of this year, and now it’s looking much more balanced.”

The question remains: Are we headed for a recession at a faster pace than the Fed can handle?

“As much as the Fed might not want to see more deterioration, the simple fact is they have already raised rates a very long way, left rates at a very high level for quite a while, and monetary policy obviously operates at a lag,” Allen said.

“So I think some further deterioration is already in the pipeline.”

Liquor Sales Continue to Fall

Constellation Brands (NYSE: STZ) concerned investors this week after announcing that it expects to take a $2.5 billion hit this quarter due to limp sales of wine and spirits.

The company — which owns everything from Corona to Kim Crawford wines to Svedka Vodka — has lowered its forecast for annual net sales from a range of between 6% and 7% to a new range of between 4% and 6%.

In addition, Constellation expects fiscal 2025 earnings of between $3.05 and $7.92 per share — a far cry from the earlier forecast range of between $14.63 and $14.93 per share.

This reflects consumer trends of cutting back spending on wine and spirits. Although the company has reported strong sales among its beer brands, Americans are shunning alcohol as their pocketbooks become more pronouncedly pinched.

In addition, rising cannabis sales haven’t helped the industry, either.

According to reports, daily marijuana use has now eclipsed daily alcohol imbibing.

In fact, cannabis has become one of the biggest cash crops in the U.S.

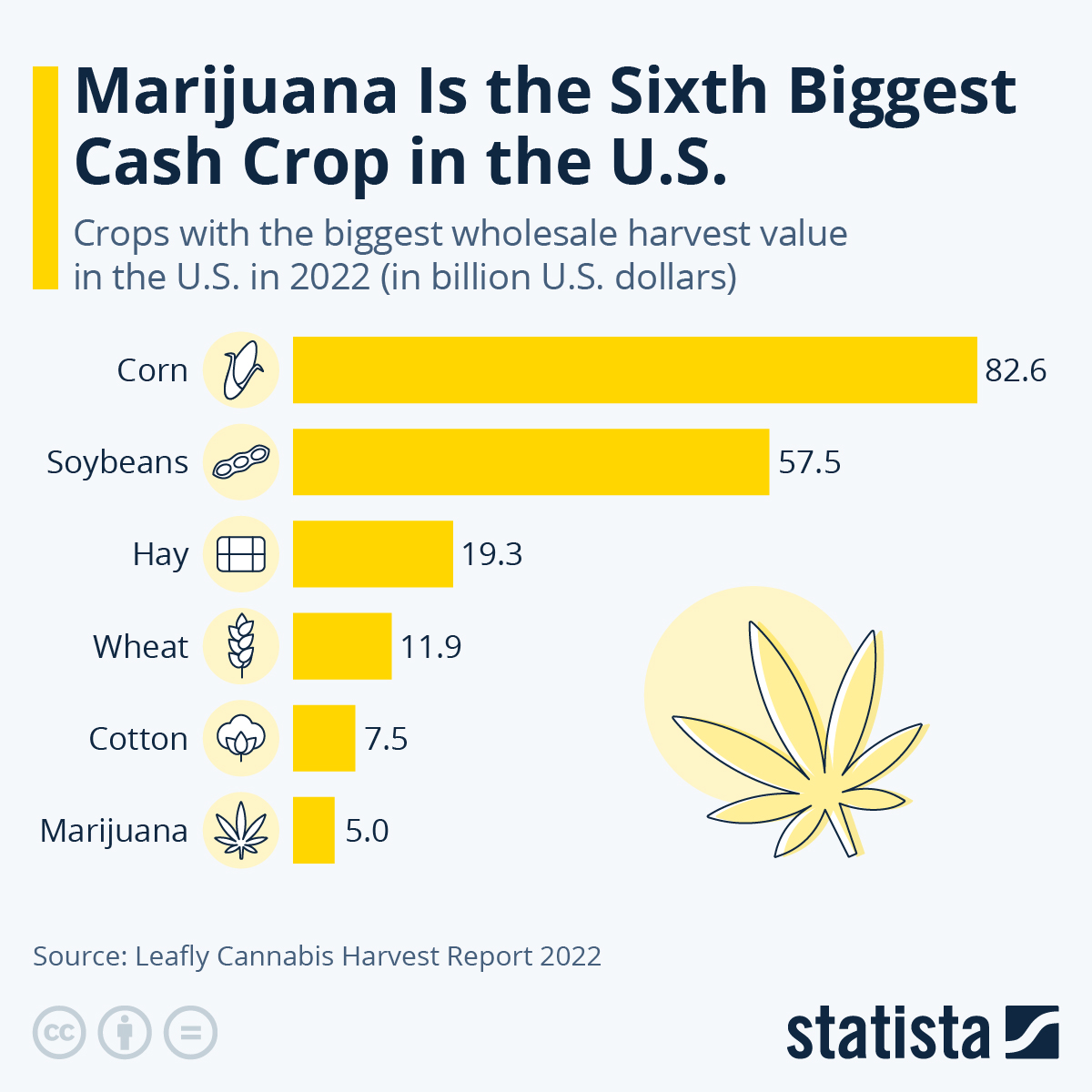

According to the most recent Leafly Cannabis Harvest Report, marijuana was the sixth most valuable wholesale crop in the U.S. in 2022, with $5 billion worth sold.

That puts cannabis in sixth place, behind staple crops corn, soybeans hay, wheat, and cotton.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

This year is shaping up to be a momentous one for cannabis stocks, thanks to the upcoming election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

To find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

Don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.