Apple AI Investing, Satellite TV, and More!

Editor’s Note: Howdy, dear reader. I hope you are having a great week so far.

Unfortunately, today’s issue of StreetAuthority Insider is also the last. I hope you have enjoyed our twice-weekly chats. I know that I have.

For the last time, let’s get to it.

Apple Drops out of OpenAI Investment Talks

In a twist that no one saw coming, Apple (NSDQ: AAPL) has reportedly backed out of its plans to participate in ChatGPT maker OpenAI’s latest funding round.

Initially, Apple had been in discussions to contribute to a $6.5 billion fundraising effort that could value OpenAI at over $100 billion.

However, as the deadline for closing the round approaches, Apple has mysteriously decided to step away, leaving the tech world buzzing with speculation.

This is particularly surprising given Apple’s recent ventures into the world of artificial intelligence (AI).

With OpenAI’s meteoric rise and the ongoing AI competition, Apple seemed primed to join forces with the company responsible for ChatGPT.

After all, Apple has already announced plans to integrate ChatGPT into its Siri virtual assistant as part of iOS 18, iPadOS 18, and macOS Sequoia later this year. So why the sudden change of heart?

It’s unclear what spurred Apple’s decision to walk away. Some speculate it may have to do with OpenAI’s recent internal restructuring and growing pains as it shifts to a more profit-driven model.

Others wonder whether Apple has its own secret AI plans that don’t involve jumping on the ChatGPT bandwagon just yet.

Meanwhile, Apple’s tech rivals remain very much in the game.

Microsoft (NSDQ: MSFT), which has already invested a staggering $13 billion in OpenAI, is expected to throw another $1 billion into this latest round.

Nvidia (NSDQ: NVDA), a leader in AI hardware, is also reportedly keen to jump in.

Despite its withdrawal from the funding round, Apple’s ChatGPT integration plans are still on track. Siri will soon be able to deliver ChatGPT-powered responses with a simple user permission. Apple also says iPhone, iPad, and Mac users will be able to use ChatGPT for free.

So while Apple may have decided to bow out of the investment race for now, it looks like it’s still all-in when it comes to giving Siri a serious AI upgrade.

And who knows? Maybe Apple is cooking up its own AI surprise for us, waiting to strike at the perfect moment.

DirecTV to Acquire Dish Network

In a significant move for the satellite TV industry, DirecTV announced on Monday that it would acquire rival Dish Network (NSDQ: DISH), ending decades of intermittent talks about merging the two companies.

This merger reflects the growing challenges both companies have faced in the age of streaming, where platforms like Netflix (NSDQ: NFLX), Hulu, and Amazon (NSDQ: AMZN) Prime Video have lured millions of subscribers away from traditional pay TV services.

DirecTV and Dish have been hemorrhaging subscribers in recent years, struggling to justify rising subscription fees as more consumers opt for cheaper, on-demand streaming services.

By combining forces, the companies hope to create a stronger competitor in a media landscape increasingly dominated by tech giants.

The newly merged entity will be better equipped to negotiate with programmers, offer streamlined packages, and reduce operational costs.

Under the terms of the deal, DirecTV will pay Dish’s parent company, EchoStar (NSDQ: SATS), just $1 in exchange for taking on Dish’s significant debt load.

EchoStar has been grappling with billions of dollars in debt, and the deal offers a much-needed lifeline for the company.

DirecTV’s private equity partner, TPG, will acquire AT&T’s (NYSE: T) remaining 70% stake in DirecTV as part of the agreement. This follows AT&T’s previous decision to sell a 30% stake in the company to TPG in 2021.

However, the merger still faces one major hurdle: Dish bondholders must agree to reduce the company’s net debt below $1.56 billion. If bondholders don’t cooperate, Dish could face bankruptcy.

To mitigate this risk, TPG and DirecTV will provide Dish with a $10 billion loan to help the company meet its debt obligations.

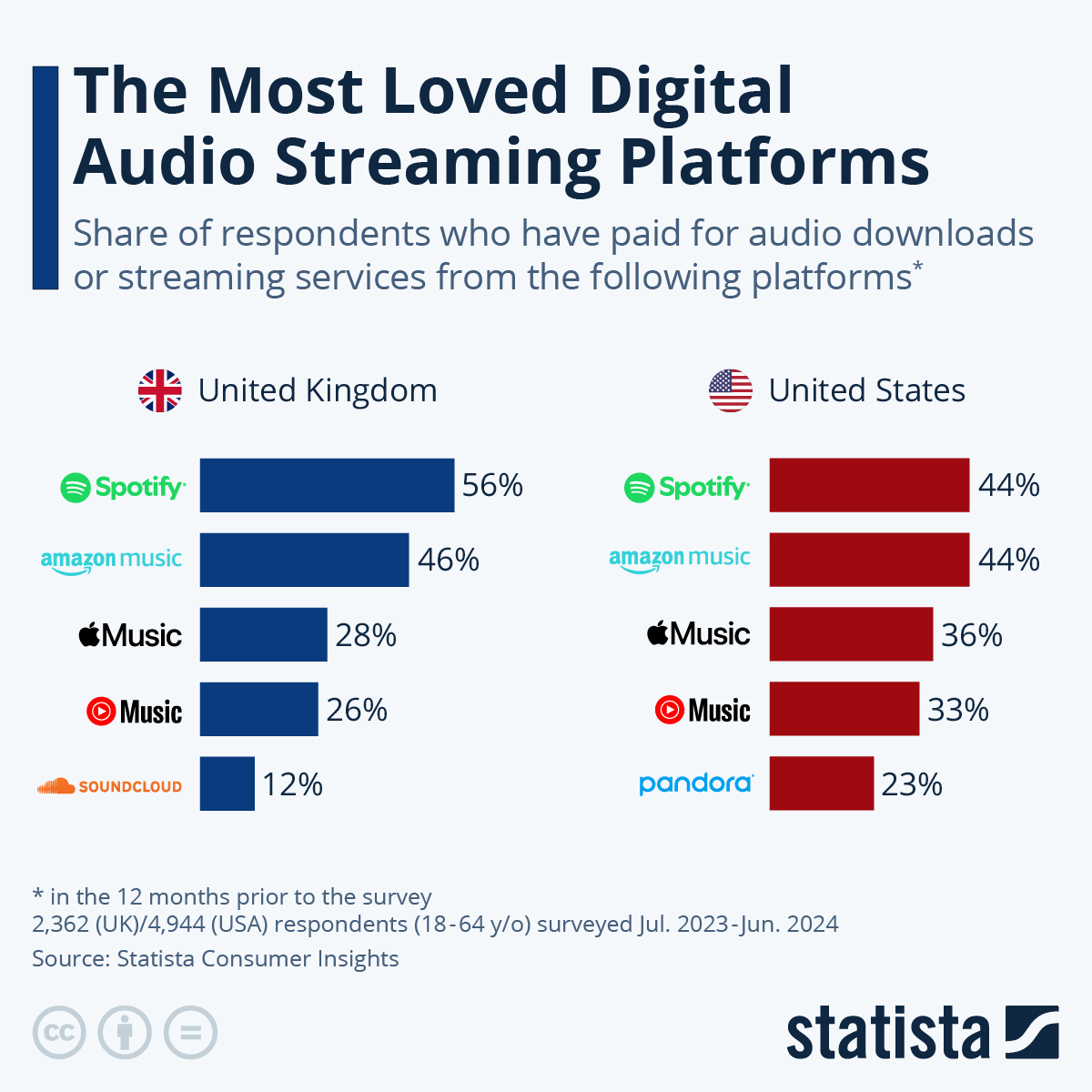

The Top Music Streaming Platforms

Over the past decade, digital audio streaming has grown exponentially.

According to Statista’s Digital Music Outlook, the music streaming market reached a staggering value of $25.84 billion in 2023, amassing nearly 900 million users globally.

During the pandemic, the podcast industry experienced a notable surge in popularity as people stuck at home sought new forms of entertainment.

This surge in listenership prompted increased advertiser investment. Megaphone, a podcast technology company owned by Spotify (NYSE: SPOT), described 2021 as a year of “content explosion,” while 2022 marked a shift toward “diversification.”

Significant growth in podcast downloads came from countries newer to the medium, including Spain (up 298%), Italy (up 244%), and France (up 375%). Age groups also showed significant increases, with 13-17 year-olds growing by 49% and 55-64 year-olds by 45%.

Several major players dominate the digital audio space, with Spotify, originally from Sweden, leading the pack alongside U.S.-based Amazon Music.

Statista’s Consumer Insights survey shows that in the U.S., Spotify and Amazon Music are the most popular streaming services, with over 40% of respondents who had purchased streaming services in the last 12 months using these platforms.

Notably, both music and podcasts are grouped together in this data, reflecting the broader diversification within the audio-streaming sector.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Editor’s Note: Are you looking for an investment strategy that makes money in up or down markets? Consider the advice of my colleague Jim Fink.

In a new presentation, Jim Fink can show you how to receive regular payments of $2,950 or more. He calls it his “I.V.L. System” and it generates winners at a mind-boggling clip. His system, offered under the aegis of Options for Income, works for beginners and for seasoned trading experts alike.

Even if you’re still unsure how options trading works…this system is for you. Or if you’re a pro who trades 10 contracts a day…this is for you, too. Jim’s I.V.L. system works in up or down markets, when inflation is elevated or low, and regardless of Federal Reserve monetary policy.

Jim likes to keep it simple. Every week, he’ll send you easy-to-follow instructions that’ll put you on Wall Street’s payment list. You’ll get the money right away, up-front, in your trading account.

Jim Fink made himself rich trading options. Now he gets his kicks helping other people get rich. Want to earn life-changing income? Click here.