An 18.5% Gain In One Day? This Strategy Makes It Possible…

There’s a saying on Wall Street: If you get into a cab and the driver begins talking to you about the market or a supposedly “hot” stock tip, it’s time to sell.

#-ad_banner-#I remember during the dot-com bubble, when it seemed like everyone and their dog was playing the market, nearly every dinner conversation with acquaintances and friends would inevitably turn from sports or politics to the market.

We all know how that turned out…

Recently, my colleague Jared Levy had a similar experience. I’ll let him share the story with you…

| After a nice dinner last week, a friend and I were enjoying a couple mezcal margaritas when a 21-year-old bar back overheard our market-centric conversation and excitedly told us that he had just bought his first shares of stock after hearing how strong the market was from a friend. Nothing against the 21-year-old bar backs of the world, but after five minutes of chatting, I realized he was mostly clueless as to how stocks derive their value. Worse still was his extraordinary confidence. But his behavior is quite common among the average investing community. Many investors hear a tip, buy a stock and hope for the best. In fact, one of the most common anecdotes I’ve heard on Wall Street is how market neophytes can predict the end of a trend. Said another way, when the average waiter, McDonald’s employee or bar back tells you how great the market is doing… it’s probably time to get out. The logic is that hedge funds and Wall Street insiders are often the first to get in, driving much of a rally, then the wealthiest investors with the best advisors hop on board, followed by savvy traders and self-directed investors, with the common citizen last to join the party after news of the rally finally reaches the masses. By the time all of that happens, valuations are typically astronomical and the smart money begins selling to capture the massive profits it already has on the table. And it seems like this time is no different. After digging into several market indicators, it looks like my faithful bar back may unfortunately be one of the last bulls in this current rally to buy. |

After doing some investigation, Jared concluded that most investors are already “all in.” According the National Association of Active Investment Managers, market sentiment has reached the same levels we experienced in April last year, just before three minor corrections — in May, June and July — and before the market completely fell apart in August and January.

This time around, according to Jared, the fundamental situation is “much worse.” Valuations are higher than they were a year ago, and earnings growth has fallen for nearly four consecutive quarters (which hasn’t happened since the Great Recession).

Here’s more from Jared:

| This surprising investor complacency is also reflected in the Volatility S&P 500 (VIX), which has settled back into its year-ago levels. The VIX tells us how much “fear” or volatility premium is factored into the price of options. When investors believe stocks will go up in an orderly fashion, VIX is low; when investors are scared and see large, usually bearish moves on the horizon, VIX surges higher. Currently, we’re seeing the VIX trading back below its long-term average (red line), near where it was last April.  Very low VIX readings, like the 15.22 reading we are seeing now, are generally a good sign that all the bulls are already in the markets. Unlike my giddy bar back friend and a good number of average investors, the smart money is NOT buying here. There’s a saying on Wall Street: “When the VIX is low, it’s time to go.” When the market is as bullish as it can be, it’s an ideal time to start taking profits, which means we’ll likely start seeing the smart money get out while the getting’s good. |

As Jared points out, the problem is that if every single “bullish” investor is already in the market, there isn’t anyone left to come in and buy when prices begin to fall. In short, if all buyers are about as bullish as they can be, then the only sentiment that can take hold from here is “bearishness.”

All of this led Jared to issue a solid recommendation to readers of his Profit Amplifier service that turned out to be right on the money.

After reading the tea leaves, Jared came to the conclusion that a small pullback was in store for the S&P 500. So he recommended buying put options on the SPDR S&P 500 ETF (NYSE: SPY), a very liquid exchange-traded fund that closely tracks the S&P 500 index.

But what happened next surprised even Jared…

The very next morning after issuing this recommendation, the market quickly sold off, sending SPY down 1%, and sending the puts Jared recommended soaring past his target price at $8. This triggered a “sell” order for any reader that followed his advice, netting them an 18.5% gain in just one day, or 6,759% annualized.

Jared’s bearish feelings on the market still hold. And he’s been spot on with his analysis, so whether you follow his service or not, I think it’s safe to say caution is warranted right now. If volatility spikes in the weeks to come, then prices will likely fall. You may want to be prepared by placing stop-loss orders on some of your holdings, and perhaps even consider taking profits on some of your recent winners.

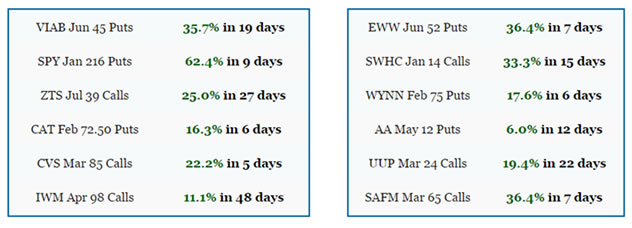

However, as we’ve been saying for months, you can profit no matter which direction the market moves by following Jared’s simple options strategies. Just take a look at some of the recent trades his Profit Amplifier readers have made:

If you’d like to follow along with Jared’s trades, we’re offering an incredible deal for his service right now. We normally charge $1,000 per year for Profit Amplifier. But if you try it today, we’ll give you full access at a one-time introductory rate of just $49 a month.

You’ll get one trade recommendation each week, with your very first trade delivered to your inbox minutes after you sign up. We’ll also send you six free premium reports that are chock full of useful information on making profitable options trades and more. Also, as a special bonus, our friends at Profitable Trading will send you a free copy of Jared’s best-selling book, “Your Options Handbook.”

It normally retails for $42 on Amazon — but you’ll get it for free if you try Profit Amplifier today.

This is an incredible deal. If you give Jared’s service a try and decide it’s not for you, simply cancel your monthly membership at any time, keep the free reports and book I just mentioned, and you’ll never be charged again. To go straight to our order page without having to watch a long video, simply click here.