3 Stocks That Keep Up With The Cost Of Health Care

Fidelity recently released its annual study of retirement health care costs. The news, as it has been for the last decade, is not good.

A newly-retired, 65-year old couple will need an estimated $275,000 in savings just to pay for healthcare. That’s a 6% jump from last year’s estimate and more than three times the general rate of consumer inflation.

If that sounds like a hard pill to swallow for those trying to retire, it’s only going to get worse. At the rate of expected increases in health care costs, a 45-year old couple could need as much as $800,000 just to pay for medical expenses when they prepare to retire in 20 years!

Health Care Costs Are Doubling Every Decade

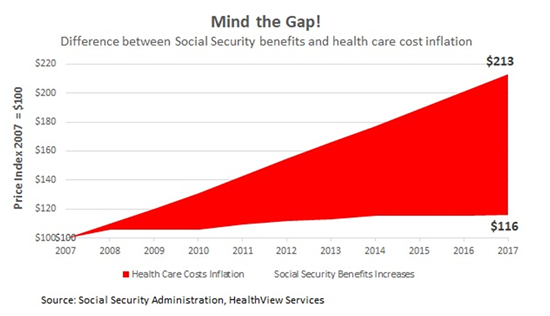

While health care cost inflation has slowed from an 11.9% surge in 2007, costs have increased at a compound rate of 7.85% annually over the last decade. In another report, HealthView Services estimated health care expenses could rise at an annual average rate of 5.5% over the next decade, more than double the 2.6% annual projected cost-of-living adjustment (COLA) on Social Security benefits.

That gap between cost-of-living adjustments and health care cost increases is immense on a compounded basis. COLA increases have grown at a rate of just 1.5% annually over the last decade, more than 6% under the rate of increase in health care costs.

Monthly premiums for Medicare and gap insurance account for about 35% of the cost, with the remaining portion paid to cost-sharing, co-payments, and out-of-pocket payments for prescription drugs.

#-ad_banner-#Premiums for Medicare Part D insurance for prescription drugs are expected to grow the fastest, at a rate of 8% annually. Other Medicare and supplemental insurance premiums are expected to rise as much as 7.2% annually.

After insurance premiums, the majority of out-of-pocket costs for retirees come from hospitals, doctors and prescription drugs with expected cost increases of 3% to 3.7% annually.

How To Beat The Rising Cost Of Retirement Health Care

Waiting for the government to find a practical solution to the surging cost of health care is the equivalent of burying your head in the sand and hoping nothing happens to your rear end.

But there is a way to get out ahead of rising health care costs: to tie your fortune to the uptrend in prices.

If it’s true that “If you can’t beat ’em, join ’em,” then the best way to protect your retirement savings from runaway health care costs is to profit as those costs continue higher.

One way is by investing in best-of-breed healthcare companies in segments where costs are rising fastest. Returns on shares may not correlate perfectly with health care cost increases over the years but rising prices will add to sales growth for these companies and should add to the bottom line.

Focusing on the segments with the highest cost inflation means looking for solid performers in insurance, prescription drugs, and medical services.

Anthem Inc (NYSE: ANTM) recently terminated its planned merger with Cigna, but the company is still one of the largest managed-care organizations in the country with 40 million members. Shares have produced a 10.8% annual return over the last decade and trade for a price-to-book value ratio of just 1.9, a 39% discount to the industry average of 3.1.

Shares of Anthem present a win-win scenario for investors. If health care costs continue to rise faster than overall inflation, consumers will rely more heavily on insurance and the insurer will see premiums increase. If health care cost inflation slows, Anthem pays out less on claims and books a stronger profit. Health insurance premiums account for 67% of total health care spending for those over 65 years, making an insurance pick one of the most important in your retirement portfolio.

CVS Health (NYSE: CVS) is becoming a one-stop shop for health care, combining its MinuteClinic health services with one of the nation’s largest pharmacy benefits managers (PBM) and pharmacy retail operations. Shares have produced a 9.3% annual return over the last decade and pay a 2.6% dividend yield.

The company’s vertical integration from its PBM that can negotiate discounted drug prices to its retail pharmacy and health services gives it unmatched customer control. The operating margin has fallen nearly a percent from 6.3% in 2014 as the company focused on growth but a new goal of profitability could lead to an upside surprise on earnings. Shares trade for 15.1 times trailing earnings, a 25% discount to the five-year average of 20 and below the industry-average 19.4.

Allergan (NYSE: AGN) has produced a 22.3% annual return for investors over the last decade and has a solid pipeline that should continue to grow sales. The specialty drug maker has $5.8 billion in balance sheet cash and no debt, a surprisingly strong financial situation when so many in the industry are facing debt problems.

Allergan’s sale of its generics business last year to Teva seems perfectly timed in the face of now-rising generics competition. The company expanded its share repurchase plan to $15 billion late last year and initiated a $0.70 quarterly dividend. Pipeline strength and its partnership with Amgen for biosimilars should produce strong cash flows and investors could see an increase in cash return.

Risks To Consider: Stock prices of health care companies won’t perfectly correlate with rising costs but should provide a closely-related increase relative to investment in other companies.

Action To Take: Protect your retirement savings against rising health care costs with these best-of-breed companies in drugs, health insurance, and medical care.

Editor’s Note: Everyone knows that Social Security is in bad shape. But most people don’t realize just how desperate the situation is… to fix Social Security benefits have to be cut by 22% immediately. Or payroll taxes have to jump by 32%. So you’re facing pain whether you’re working OR retired. But there’s a way out. A program that can pay you $43,543 per year for the rest of your life. And it has nothing to do with the government. Check it out here.